|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Mortgage Based on Credit Score: What to ExpectWhen you're considering a mortgage, your credit score is a significant factor. It affects the terms you might qualify for and can influence your financial future. Let's explore how credit scores impact mortgages and what you can expect. How Credit Scores Affect Mortgage RatesYour credit score is a numerical representation of your creditworthiness. Lenders use this score to determine the interest rate on your mortgage. A higher credit score often results in a lower interest rate, potentially saving you thousands over the life of the loan.

Understanding your score helps you anticipate the rates you might encounter. Improving Your Credit ScorePay Bills on TimeTimely payments are crucial. Late payments can significantly impact your credit score. Reduce DebtLowering your debt-to-income ratio can improve your score. Consider strategies to pay down existing debt. Check Credit ReportsRegularly reviewing your credit reports helps you identify and dispute inaccuracies. Types of Mortgages Based on Credit ScoreDifferent types of mortgages may be more accessible depending on your credit score.

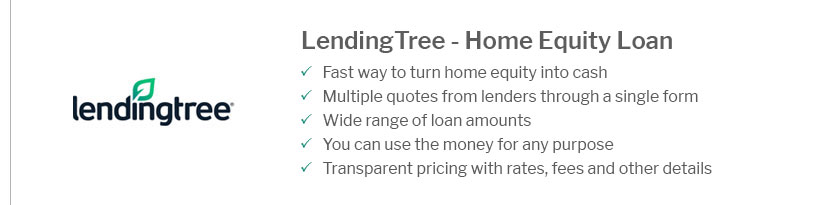

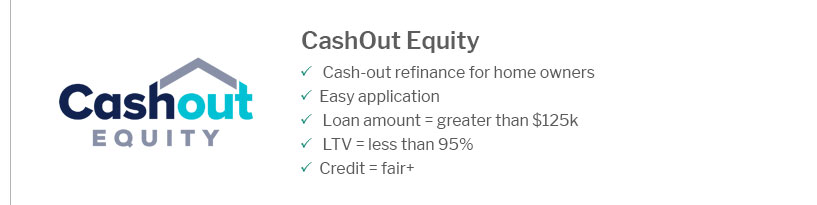

Consider a cash out refinance if you're looking to access home equity under favorable terms. FAQWhat is the minimum credit score needed for a mortgage?The minimum credit score varies by loan type. Conventional loans typically require at least 620, while FHA loans may accept scores as low as 500 with a larger down payment. Can I get a mortgage with bad credit?Yes, but options may be limited. You may need to consider FHA loans or seek a co-signer to improve your chances. How can I improve my mortgage eligibility?Focus on improving your credit score, reducing debt, and ensuring stable income. Consider a mortgage loan 30 year fixed if you prefer long-term stability. https://themortgagereports.com/87625/mortgage-rates-by-credit-score

Mortgage rates by credit score ; 760-850, 7.242% ; 700-759, 7.449% ; 680-699, 7.555% ; 660-679, 7.609% ; 640-659, 7.711%. https://www.bankrate.com/real-estate/what-credit-score-do-you-need-to-buy-a-house/

Generally, the higher your credit score, the more likely you'll qualify for a mortgage loan with these lenders. Many will accept a credit score ... https://www.consumerfinance.gov/ask-cfpb/does-my-credit-score-affect-my-ability-to-get-a-mortgage-loan-or-the-mortgage-rate-i-pay-en-319/

Your credit score is calculated based on the information in your credit report. Higher scores reflect a better credit history and make you ...

|

|---|